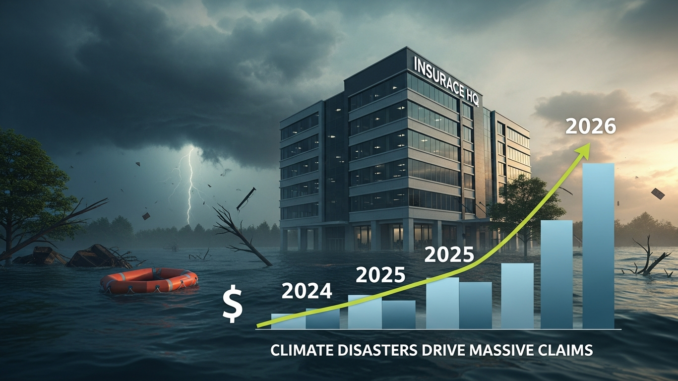

Insurance premiums across multiple regions are expected to rise in 2026 as climate-related disasters continue to generate record-breaking claims. From wildfires and floods to severe storms, insurers worldwide are reassessing risk models and pricing strategies to maintain financial stability.

This shift is not driven by speculation but by sustained increases in insured losses over recent years, making premium adjustments increasingly unavoidable.

Rising Climate Risks Are Reshaping Insurance Costs

Climate change has significantly altered the frequency and severity of natural disasters. Events that were once considered rare are now occurring with alarming regularity. As a result, insurers are facing mounting payouts across property, auto, and agricultural insurance sectors.

In several regions, insured losses from extreme weather events in 2025 exceeded long-term averages. This trend has placed pressure on insurers to rebalance risk portfolios and ensure sufficient reserves for future claims.

Key impact:

When claim costs rise consistently, insurers must increase premiums to cover future liabilities and maintain solvency.

Which Insurance Types Are Most Affected?

Premium increases are expected to vary depending on coverage type and geographic exposure. The most impacted insurance categories include:

-

Home and property insurance – Higher risks from floods, fires, and storms

-

Auto insurance – Increased weather-related vehicle damage

-

Commercial insurance – Greater exposure for businesses operating in high-risk zones

Policyholders in climate-vulnerable areas are likely to experience sharper increases than those in lower-risk regions.

Why Insurers Cannot Absorb the Costs Alone

Insurance companies operate on long-term risk projections. Persistent climate losses disrupt these projections, increasing the cost of reinsurance — insurance for insurers themselves. As reinsurance prices rise, primary insurers often pass part of the cost to consumers.

Additionally, regulatory requirements mandate insurers to hold adequate capital reserves. Without premium adjustments, insurers could face financial instability, potentially reducing coverage availability.

Industry reality:

Premium increases help preserve market stability and prevent coverage withdrawals in high-risk regions.

What Policyholders Can Expect in 2026

Consumers may notice:

-

Gradual premium increases rather than sudden spikes

-

Stricter underwriting criteria

-

Incentives for risk-reduction measures such as fire-resistant construction or flood mitigation

Some insurers are also expanding usage-based and customizable policies, allowing customers to better align coverage with actual risk.

How Consumers Can Reduce Insurance Costs

While premium increases may be unavoidable, policyholders can take proactive steps to manage costs:

-

Review policies annually to eliminate unnecessary coverage

-

Improve property safety features

-

Compare insurance providers regularly

-

Maintain strong claims history where possible

Informed consumers often secure better long-term value even during market adjustments.

Long-Term Outlook for the Insurance Industry

The insurance sector is increasingly investing in data analytics, artificial intelligence, and climate modeling to refine pricing accuracy. These advancements aim to balance affordability for customers while maintaining financial resilience for insurers.

As climate patterns continue to evolve, insurance pricing will likely become more dynamic, reflecting real-time risk rather than historical averages.

Conclusion

Insurance premium increases in 2026 are a direct response to escalating climate-related claims rather than short-term market fluctuations. While rising costs may concern consumers, these adjustments play a crucial role in preserving coverage availability and long-term industry stability.

Staying informed and proactive will help policyholders navigate these changes more effectively.

Leave a Reply